Your Quick-Start Guide to Year-End Tax Prep: Do This First to Avoid IRS Headaches

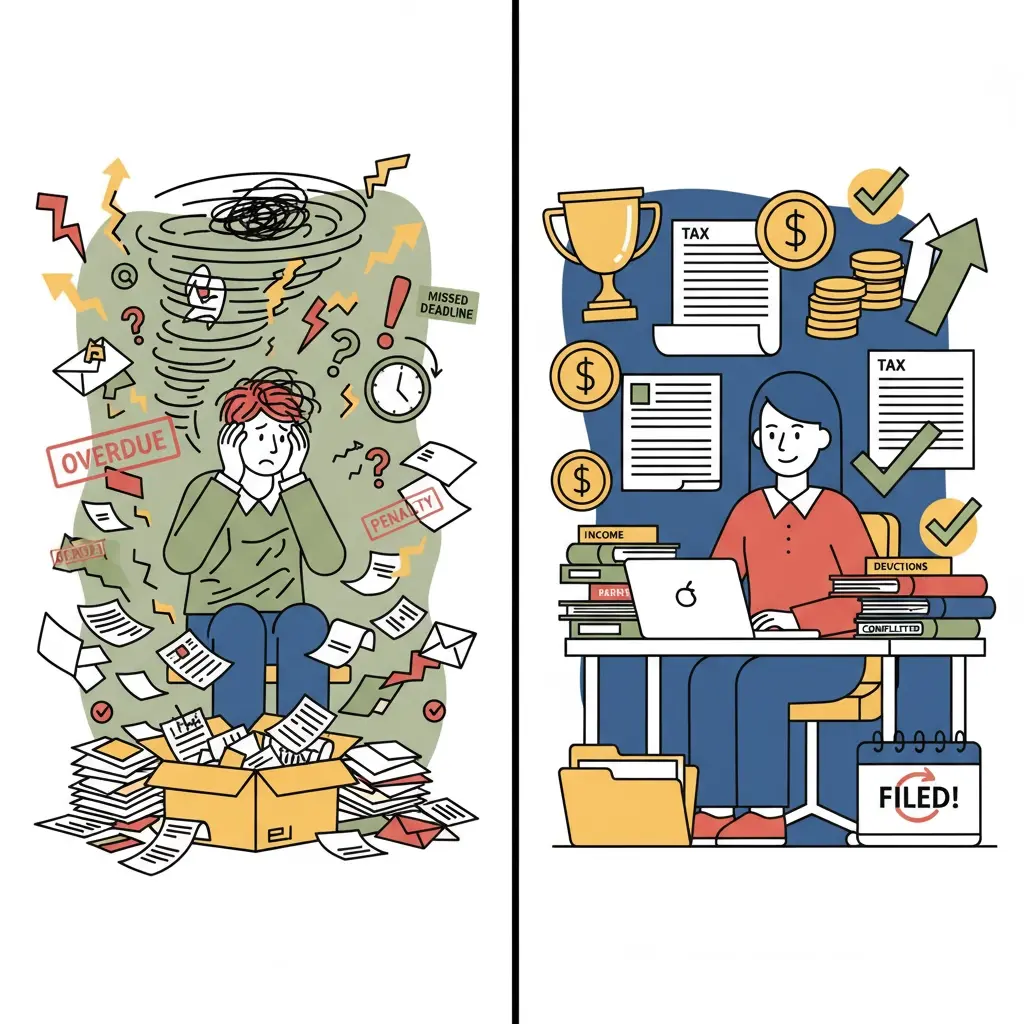

Transform tax season stress into confidence with strategic preparation that puts you ahead of the game

The calendar is turning toward year-end, and while others are scrambling through shoebox receipts in

March, you can be the person who files early, claims every deduction, and sleeps peacefully knowing

your taxes are handled. The secret isn't having a finance degree: it's starting with the right foundation

now.

Why Early Tax Prep Is Your Secret Weapon

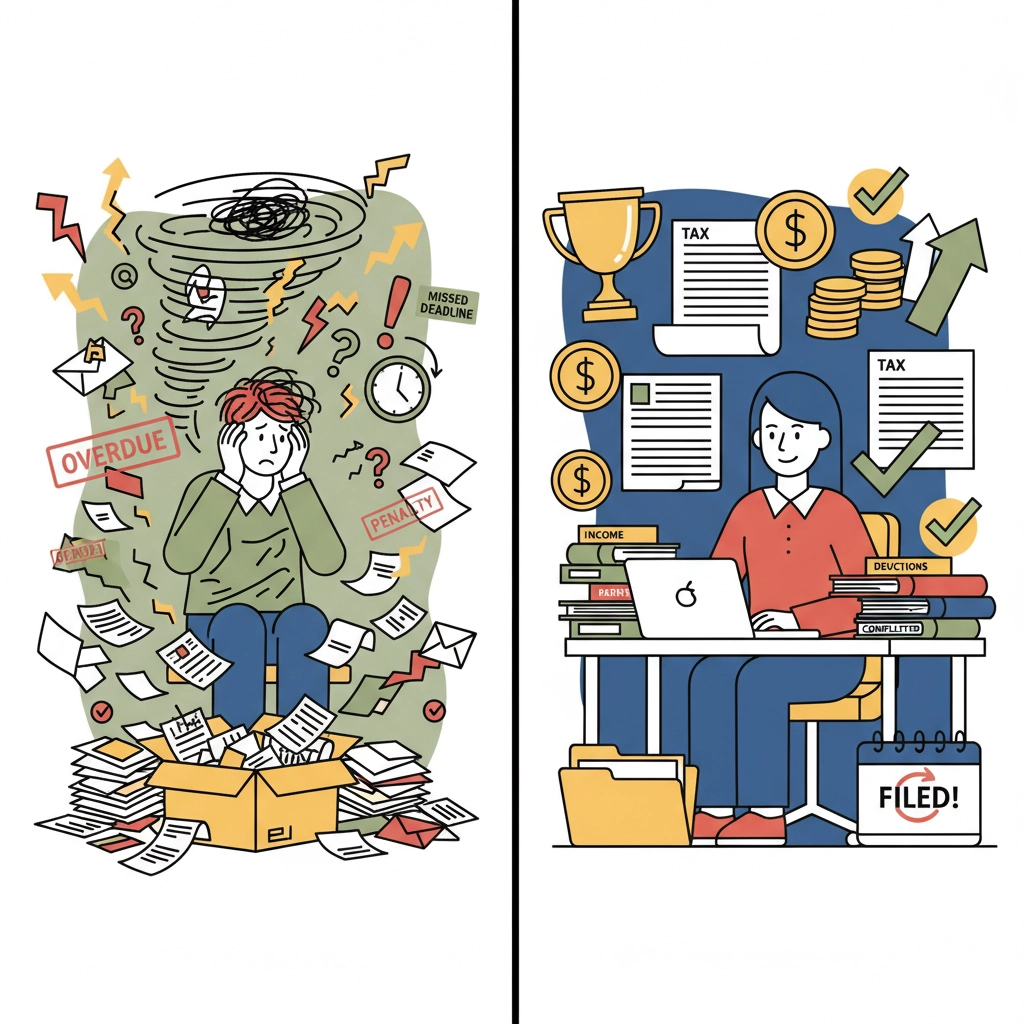

Most taxpayers wait until January to even think about taxes, then panic when April looms. But here's

what the pros know: year-end tax preparation isn't about doing your taxes early: it's about setting yourself up so tax filing becomes effortless.

When you start now, you avoid the three biggest tax nightmares:

• Missing documents that arrive after you've already filed

• Overlooked deductions because you rushed through preparation

• IRS processing delays that hold up your refund for months

Your 30-Day Action Plan: What to Do Right Now

Week 1: Gather Your Foundation Documents

Start with the basics that never change. Create a dedicated folder: physical or digital: and collect:

• Social Security numbers for yourself, spouse, and all dependents

• Last year's tax return (you'll need your Adjusted Gross Income from line 11 for e-filing)

• Government-issued photo ID (driver's license works perfectly)

• Bank account information for direct deposit of any refund

Pro tip: Take a photo of your previous year's tax return with your phone right now. You'll thank yourself later when you need that AGI number for e-filing verification.

Week 2: Set Up Your Income Document System

This is where most people get overwhelmed, but we're going to make it simple. Create separate folders for:

Employment Income:

• W-2 forms from all employers

• 1099-NEC for freelance/contract work

• 1099-MISC for other miscellaneous income

Investment Income:

• 1099-DIV (dividends)

• 1099-INT (interest)

• 1099-B (stock sales)

• 1099-K (payment card transactions)

Retirement & Benefits:

• 1099-R (pensions, IRA distributions)

• SSA-1099 (Social Security benefits)

• HSA statements

Week 3: Organize Your Deduction Documentation

Here's where you can really save money: if you're organized. Most taxpayers miss hundreds or

even thousands in deductions simply because they can't find the paperwork.

Charitable Giving:

• All donation receipts (cash and non-cash)

• Mileage logs for volunteer work

• Any goods donated to charity

Medical Expenses:

• Insurance premiums not paid through payroll

• Out-of-pocket medical, dental, vision costs

• Prescription receipts

• Mileage to medical appointments

Business & Work Expenses:

• Home office expense records

• Business mileage logs

• Professional development courses

• Work-related supplies and equipment

Education Costs:

• Tuition statements (1098-T forms)

• Student loan interest (1098-E forms)

• Educational supplies for eligible programs

• Out-of-pocket medical, dental, vision costs

• Prescription receipts

• Mileage to medical appointments

Business & Work Expenses:

• Home office expense records

• Business mileage logs

• Professional development courses

• Work-related supplies and equipment

Education Costs:

• Tuition statements (1098-T forms)

• Student loan interest (1098-E forms)

• Educational supplies for eligible programs

Week 4: Handle the Complex Stuff

Property & Investment Records:

• Mortgage interest statements (1098 forms)

• Property tax records

• Home improvement receipts (these add to your cost basis)

• Real estate closing statements

Tax Payments Made:

• Estimated quarterly tax payments

• State tax payments

• Prior year tax payments made in the current year

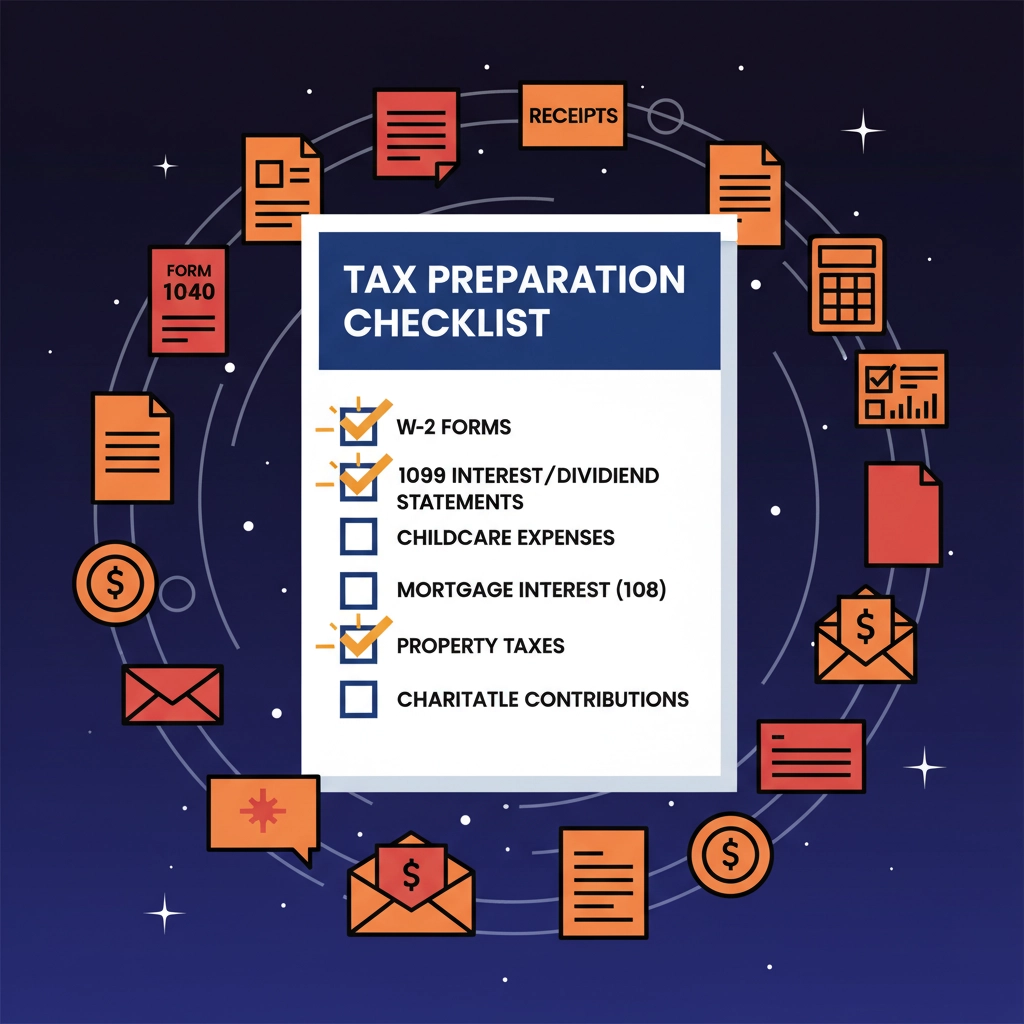

The Professional's Document Checklist

Print this checklist and check off each item as you collect it. Missing even one document can delay

your refund by weeks.

Income Documents ✓

W-2s from all employers

• 1099-NEC (self-employment)

• 1099-MISC (miscellaneous income)

• 1099-INT (interest income)

• 1099-DIV (dividend income)

1099-B (investment sales)

• 1099-R (retirement distributions)

• SSA-1099 (Social Security)

• 1099-G (unemployment, state refunds)

Deduction Documents ✓

• Charitable donation receipts

• Medical expense receipts

• Mortgage interest statements (1098)

• Property tax records

• State and local tax payments

• Student loan interest (1098-E)

• Tuition payments (1098-T)

• Business expense receipts

• Childcare provider information

Investment & Property Records ✓

• Stock purchase/sale records

• Cryptocurrency transaction records

• Real estate closing statements

• Rental property income/expense records

• Cost basis information for sales

Pro Organization Tips That Save Hours

Create a tax calendar. Mark these key dates:

• January 31: Deadline for employers to send W-2s

• January 31: Deadline for most 1099 forms

• February 15: Some investment 1099s may arrive later

• March 15: Deadline for partnership and S-Corp returns

Use the "one-touch" rule. When a tax document arrives, immediately put it in your tax folder. Don't

set it aside "for later": that's how documents get lost.

Take photos as backup. Even if you prefer physical documents, take phone photos of everything.

Cloud storage means you'll never lose a crucial receipt again.

Common Year-End Mistakes That Cost Money

Mistake #1: Waiting for "all" documents to arrive. Some 1099s arrive in March. File when you

have your main documents, then amend if needed.

Mistake #2: Forgetting about cryptocurrency. Every crypto transaction is taxable. Use software to

track these if you trade actively.

Mistake #3: Missing state-specific deductions. Some states offer unique tax breaks. Research yours

or work with a local professional.

Mistake #4: Not maximizing retirement contributions. You have until April 15 to contribute to

IRAs for the previous tax year.

When to Call in Professional Help

You should consider professional tax preparation if:

• Your situation changed significantly (marriage, divorce, new business)

• You have rental property or complex investments

• You received a large inheritance or settlement

• You're behind on previous years' returns

• The IRS has contacted you about any issues

At Number Woman Bookkeeping, we see too many small business owners try to handle complex tax

situations alone: then end up with IRS notices or missed deductions that cost more than professional

help would have.

Your December Action Items

Before December 31, you can still:

• Make additional retirement plan contributions

• Harvest investment losses to offset gains

• Pay estimated taxes to avoid penalties

• Make charitable donations for this tax year

• Purchase business equipment for immediate deductions

After January 1, these opportunities are gone forever for this tax year.

Ready to File With Confidence?

Starting your tax prep now transforms what most people see as a dreaded annual chore into a

smooth, organized process. You'll file early, maximize your deductions, and get your refund faster.

The best part? Next year, you'll already have systems in place that make tax preparation even easier.

Empowering Businesses to Thrive One Number at a Time

Whether you're a seasoned entrepreneur or just getting started, having organized, accurate financial

records makes tax season: and every business decision: clearer and more confident.

Ready to make tax season your secret weapon instead of your biggest stress? The time to start is

now, while you still have control over this year's tax story.

Need help organizing your business finances for year-end? Our team at Number Woman Bookkeeping

specializes in keeping your books tax-ready all year long. Learn more about our services and discover

why 99% of our clients stay with us year after year.